Attractive FD interest rates are offered based on the tenure of your Fixed Deposit. Have a look at the FD interest rates for different tenures. Guaranteed returns: Unlike investment in the stock market or commodity market, fixed deposits are not a risky investment as they do not depend on fluctuating market rates. Investors can rest assured that his investments are safe and he will be getting back a guaranteed amount at the end of the tenure.

Flexible in nature: Fixed deposits can be taken for a tenure of 1 year to 5 years based on your needs and for whatever amount that you can invest. If you have planned for a big event in 5 years, then you can have a fixed deposit kept for 5 years to meet your financial requirement in 5 years.

Terms & Conditions:

• It is mandatory to become a member in Emarks Nidhi Limited to open a F.D. Account.

• It is Mandatory to complete the KYC Norms.

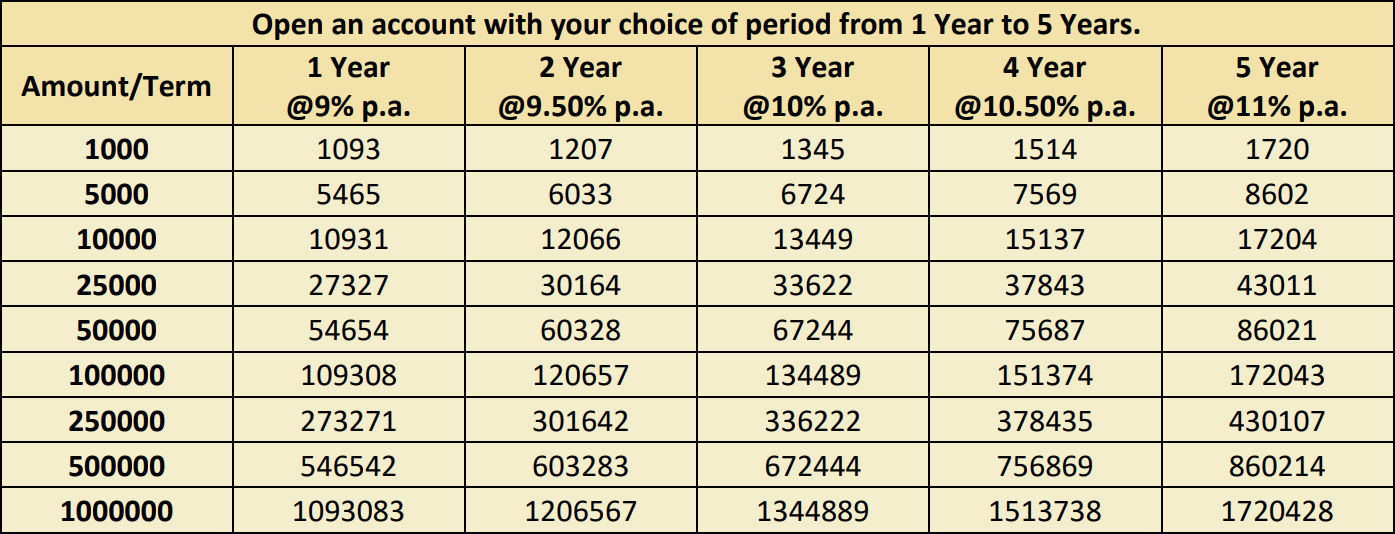

• Open an account with your choice of period from 1 Year to 5 Years.

• Interest will be calculated on quarterly compound basis.

• Interest amount is subject to TDS deductions as per existing income tax rules.

• Rate of Interest for Senior Citizens, Women & Ex-servicemen shall be 0.50% higher than normal prevailing interest rate on Fixed Deposit.

• Facilities: Loan facility is available against deposits. Nomination facility is available for deposits.

• The Member Account Holder shall surrender the F.D. Receipt/Bond/Advice and duly signed application to the company and the maturity shall be paid along with interest as per the above-mentioned Chart. No additional interest would be paid on the maturity amount, if taken after the scheduled period.

• Interest rates are subject to change at the sole discretion of the Emarks Nidhi Limited.

• Emarks Nidhi Limited reserves the right to alter or add to these rules at any time without any notice.